A Technical Outlook for Traders and Investors**

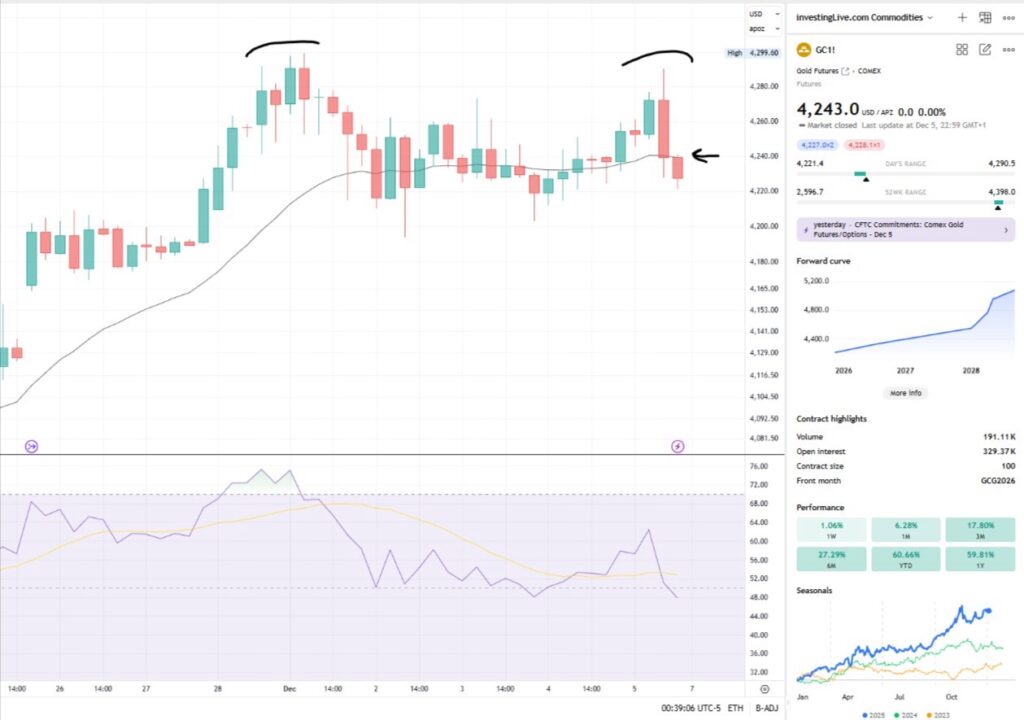

Gold’s impressive run has stalled near recent highs, leaving traders and investors wondering whether the metal is carving out a major top—or simply consolidating before the next breakout. A close look at the charts suggests the latter is more likely, but with critical levels that must hold.

The Trend: Bullish, But Momentum Has Moderated

Gold remains firmly within its broader uptrend. The market is still printing higher highs and higher lows, but upward momentum has cooled:

RSI has eased back from overbought territory, relieving buying pressure. MACD momentum has flattened but not crossed lower. Price is holding above all major moving averages.

This slowdown is typical of a maturing trend—not a reversal.

Price Action: Controlled Pullback, Not a Breakdown

The recent candles highlight a tug-of-war between two camps:

Profit-takers

Repeated upper wicks show sellers stepping in around the highs—a natural reaction after a steep run.

Dip-buyers

Despite selling pressure, the market has not seen panic or a sharp liquidation. Buyers are defending pullbacks at:

The 20-day EMA 38.2% and 50% Fibonacci retracement zones Previous breakout points

These are classic zones where bullish trends pause, regroup, and often continue.

Key Levels for Traders & Investors

Upside Resistance

The most recent swing high / psychological round number A breakout above this level with volume opens the door to another impulsive rally.

Support Zones

20-day EMA – first line of trend support 38.2% retracement – shallow, bullish continuation zone 50% retracement – deeper but still healthy reset 61.8% retracement – where a failing trend often catches its final bid

A break below the 50%–61.8% area would shift the risk profile and signal a potential trend reversal.

Volume: Favouring Consolidation, Not Exhaustion

The volume pattern supports a continuation setup:

Strong volume on the way up (healthy demand) Diminishing volume during the pullback (typical consolidation)

There’s no evidence of a blow-off top or capitulation selling.

Market Sentiment: Confidence, Not Euphoria

Sentiment across gold derivatives and ETF flows shows constructive interest, but not the kind of extreme bullishness that marks major tops. Traders remain active, but investors are still entering cautiously—normally a sign that upside potential remains.

Bottom Line: Gold Is Catching Its Breath, Not Peaking

For traders:

The current consolidation offers tactical opportunities—buying dips into support, scaling in near EMAs, or waiting for confirmation on a breakout.

For investors:

The structural trend remains intact. As long as major support levels hold, this pullback appears to be a pause within a larger bullish cycle, not the end of it.

Gold hasn’t topped. It’s resting.