As of March 26, 2025, financial markets are closely monitoring the potential impact of President Donald Trump’s proposed tariffs, particularly those set to take effect on April 2. The administration has announced a 25% tariff on imports from any country purchasing oil from Venezuela, aiming to exert economic pressure on the Venezuelan government . Additionally, tariffs on Chinese imports are slated to increase to 45% .

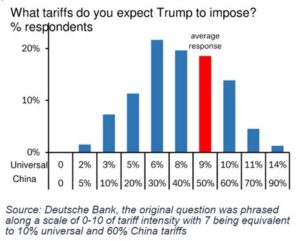

Despite a more optimistic tone from the administration regarding tariffs, investors should remain cautious. Goldman Sachs highlights two significant concerns for potential market volatility. Firstly, tariffs might be used as a negotiation tool, leading to higher tariff rates during trade talks. Secondly, investor expectations for tariff rates are low, averaging nine percentage points, while actual rates could be much higher, potentially leading to a market shock .

The S&P 500 has experienced fluctuations in response to tariff announcements. On March 25, the index edged lower by 0.1%, reflecting investor apprehension ahead of the April 2 deadline . Analysts suggest that while some tariff impacts may be priced into current market valuations, the full extent of potential economic disruptions remains uncertain.

Investors are advised to monitor upcoming policy announcements closely and consider the potential for increased market volatility as the implementation date approaches. Diversifying portfolios and staying informed on trade developments will be crucial in navigating the evolving economic landscape.