Global banking giant HSBC has offered a cautiously bullish yet nuanced forecast for gold, lifting its long-term price projections while trimming its average outlook for 2026 and flagging significant volatility risks. The new forecasts paint a picture of gold markets shaped by powerful structural drivers — but also by potential corrections tied to shifts in monetary policy and geopolitical developments.

Bullish on the Long Term, Wary in the Near Term

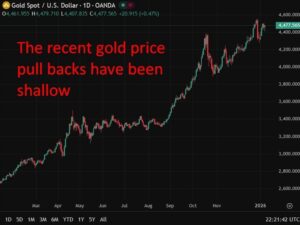

In a fresh research note, HSBC analysts reiterated that gold could surge as high as $5,000 per ounce in the first half of 2026, driven by persistent geopolitical tensions, elevated sovereign debt burdens, and sustained demand for safe-haven assets. Such a peak — if realized — would mark yet another historic milestone in gold’s already remarkable multi-year rally.

At the same time, the bank slightly trimmed its average forecast for 2026 to $4,587 per ounce, down from a previous estimate of $4,600, underscoring its conviction that near-term volatility could intensify and prices might pull back before the end of the year. HSBC sees a wide trading range of $3,950 to $5,050 for 2026, reflecting the unusual breadth of possible outcomes.

Why the Upside Could Be So Strong

HSBC’s bullish tone stems from a convergence of macroeconomic and geopolitical factors that have propelled gold to new highs:

Geopolitical uncertainty — Ongoing tensions in multiple regions have kept risk aversion elevated and bolstered demand for hard assets. Rising global government debt — Expanding fiscal deficits in major economies make traditional financial assets less attractive to risk-averse investors. Central bank buying and diversification — Many central banks continue to add gold to their reserves, reinforcing structural demand. Safe-haven appeal amid monetary policy uncertainty — The prospect of potentially looser monetary policy, or fears about abrupt shifts from central banks, has supported gold’s allure.

Taken together, these forces underpin HSBC’s view that gold’s long-term trajectory remains upward, even beyond 2026.

Longer-Term Forecasts Get a Lift

Reflecting these drivers, HSBC raised its gold price forecasts for the medium and long term. The bank now forecasts:

2027 average price: $4,625/oz (up from $3,950) 2028 average price: $4,700/oz (up from $3,630) 2029 average price: Introduced at $4,775/oz

These upgrades signal HSBC’s expectation that gold will remain elevated even after the current rally matures, supported by persistent macro risks and investor positioning.

Volatility and Correction Risks Loom Large

Despite these optimistic long-term views, HSBC emphasized price risks and the threat of a correction — especially if key assumptions change. Specifically:

If geopolitical tensions ease, safe-haven demand could weaken sharply. **If the U.S. Federal Reserve pauses or halts its rate-cutting cycle, expected liquidity drivers could diminish, prompting profit-taking among investors.

Such developments could potentially push gold prices toward the lower end of HSBC’s forecast range, creating sharp swings and testy market conditions.

Investor Implications

For investors, HSBC’s forecast underscores a classic trade-off: the metal’s long-term narrative remains intact, but short-term moves could be turbulent. Traders may find opportunities in the expected volatility, while long-term holders might see gold as a hedge against macro uncertainty and financial instability.

In broader markets, gold’s strong performance — which included a historic rally in 2025 — has already captured attention across asset classes. Other major financial institutions, including Morgan Stanley, are also projecting robust price trajectories for gold in 2026 and beyond, adding to the chorus of bullish voices in the commodities sphere.

Conclusion

HSBC’s latest outlook reinforces gold’s reputation as a strategic asset in uncertain times. While the bank trimmed its average 2026 forecast slightly and highlighted substantial risks, its view that gold could climb toward $5,000 per ounce — and remain elevated in the years ahead — suggests that gold will continue to occupy a central place in investor portfolios. As always, the path forward is likely to be shaped not just by economic fundamentals, but by geopolitical events and central-bank policy decisions that are often unpredictable.