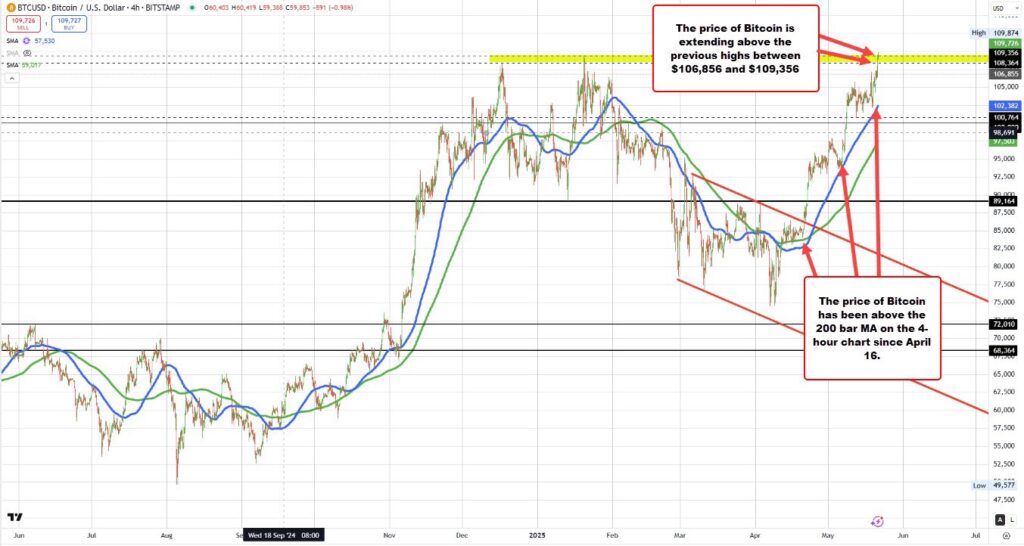

Bitcoin has smashed through previous resistance to trade at a new all-time high of $109,732, marking a historic moment for the world’s most prominent cryptocurrency. The surge extends beyond the former peak of $109,356 recorded on January 10, confirming continued bullish momentum in the digital asset market.

Market Momentum and Institutional Demand

The latest price action underscores the strength of ongoing institutional interest in Bitcoin. Over the past year, a wave of adoption from financial giants, including asset managers and hedge funds, has significantly bolstered liquidity and confidence in crypto markets. Spot Bitcoin ETFs, which gained regulatory approval in several jurisdictions, have also played a pivotal role in attracting capital inflows.

“This breakout past the January highs suggests we’re entering a new phase of the bull market,” said Elena Brooks, head of digital asset strategy at Magna Capital. “We’re seeing strong accumulation patterns and diminishing selling pressure from long-term holders.”

Macro Drivers and Inflation Hedging

Bitcoin’s rally comes amid persistent concerns about global inflation and monetary policy uncertainty. Investors are increasingly turning to decentralized assets as a hedge against currency devaluation and systemic risk. Central banks across major economies are struggling to tame inflation without triggering recession, a backdrop that continues to benefit Bitcoin and other non-sovereign assets.

“Bitcoin is acting as a macro hedge again,” said Marco Yuen, chief strategist at Fintrust Global. “It’s not just about speculation anymore—it’s about protection.”

Technical Outlook

From a technical standpoint, the break above $109,356 triggers a key bullish signal, opening the path toward the next psychological level at $115,000, with intermediate resistance near $112,000. Analysts are watching for volume confirmation to validate the breakout, as well as the behavior of futures open interest and funding rates.

Short-term volatility remains elevated, but the broader trend appears intact. Momentum indicators are rising, and the Relative Strength Index (RSI) shows sustained strength without entering dangerously overbought territory.

Broader Crypto Market Reaction

The broader cryptocurrency market has followed Bitcoin’s lead, with Ethereum trading above $5,300 for the first time and altcoins like Solana, Avalanche, and Chainlink posting double-digit daily gains. The total market capitalization of all cryptocurrencies has now surpassed $4.5 trillion, according to data from CoinMarketCap.

What’s Next?

As Bitcoin charts new territory, market participants are keeping a close eye on regulatory developments, geopolitical tensions, and macroeconomic signals. While volatility is likely to remain a feature of the crypto landscape, the latest record underscores Bitcoin’s growing role as a mainstream financial asset.

Disclaimer: Cryptocurrency investments are volatile and involve substantial risk. Investors should conduct thorough research or consult a financial advisor before making investment decisions.