Billionaire entrepreneur Elon Musk, the face of technological innovation and the driving force behind Tesla and SpaceX, is once again at the center of controversy—this time, over allegations of hard drug use. A recent exposé has accused Musk of regularly using substances such as ketamine, ecstasy (MDMA), Adderall, and psychedelic mushrooms, sparking widespread concern among investors, corporate boardrooms, and the public.

The Allegations and Public Reaction

The allegations date back to events throughout 2024, with claims that Musk’s drug use was not only known within his inner circle but had become a point of concern among Tesla and SpaceX executives. These claims were brought into sharper focus after Musk appeared in the Oval Office with a visible facial bruise, prompting questions about his health and mental well-being.

Musk has denied the allegations, attributing the facial injury to a playful incident with his son. He firmly stated that he is not using drugs and criticized the media for propagating what he calls a smear campaign. In an unusual twist, former U.S. President Donald Trump appeared alongside Musk at the White House during this period, signaling unwavering public support despite the controversy. However, Trump notably sidestepped direct questions about Musk’s alleged drug use.

Impact on Tesla’s Stock Price

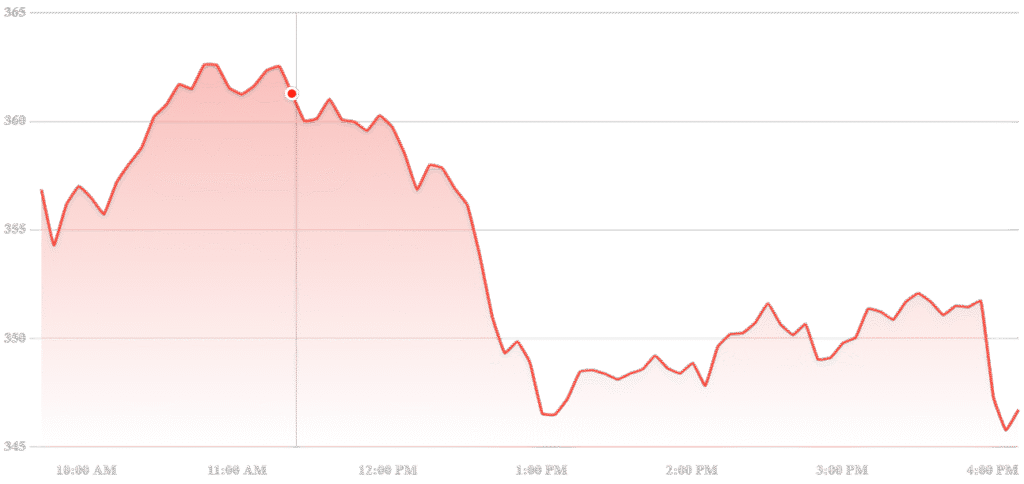

While Musk has weathered many storms in the public eye, markets tend to be less forgiving when executive behavior threatens corporate image and governance standards. Tesla’s stock (TSLA) took a noticeable hit following the drug use reports, dropping by over 3% intraday and closing down at $346.46 after hitting a high of $363.56. The decline, though not catastrophic, reflects investor jitters.

What the Price Action Tells Us

Tesla’s recent price action indicates more than just a reaction to salacious headlines. The selloff followed a period of relative strength, suggesting that market participants are re-evaluating the risk premium associated with Tesla’s leadership. When a company is so closely tied to a single charismatic figure—as Tesla is to Musk—even personal issues can cast a long shadow over valuation.

Technical indicators also show signs of near-term volatility. The stock broke below a key support level at $350, with increased trading volume hinting at institutional selling pressure. However, the fact that Tesla recovered somewhat to end the week higher suggests that not all investors are fleeing the stock. Some may view this as a temporary distraction rather than a long-term threat.

What This Means Going Forward

While no legal action or official investigation has been launched against Musk at this time, the reputational risk remains high. Institutional investors and governance-focused funds may now scrutinize Tesla’s board practices more closely, especially around executive conduct and transparency.

For Musk, the challenge is twofold: managing the narrative while ensuring the controversy doesn’t derail business operations or erode trust among stakeholders. For Tesla, this is a reminder that even the most innovative companies are vulnerable to leadership volatility.