A very busy week ahead with the release of many key economic data and central bank policy decisions, including the Fed.

UPCOMING EVENTS:

- Monday: China Retail Sales and Industrial Production, Canada PPI, US NAHB Housing Market Index.

- Tuesday: BoJ Policy Decision, RBA Policy Decision, Eurozone Wage data, Eurozone ZEW, Canada CPI, US Housing Starts and Building Permits.

- Wednesday: PBoC LPR, UK CPI, FOMC Policy Decision, New Zealand GDP.

- Thursday: Australia/Japan/Eurozone/UK/US Flash PMIs, Australia Labour Market report, SNB Policy Decision, BoE Policy Decision, US Jobless Claims.

- Friday: Japan CPI, UK Retail Sales, Canada Retail Sales.

Tuesday

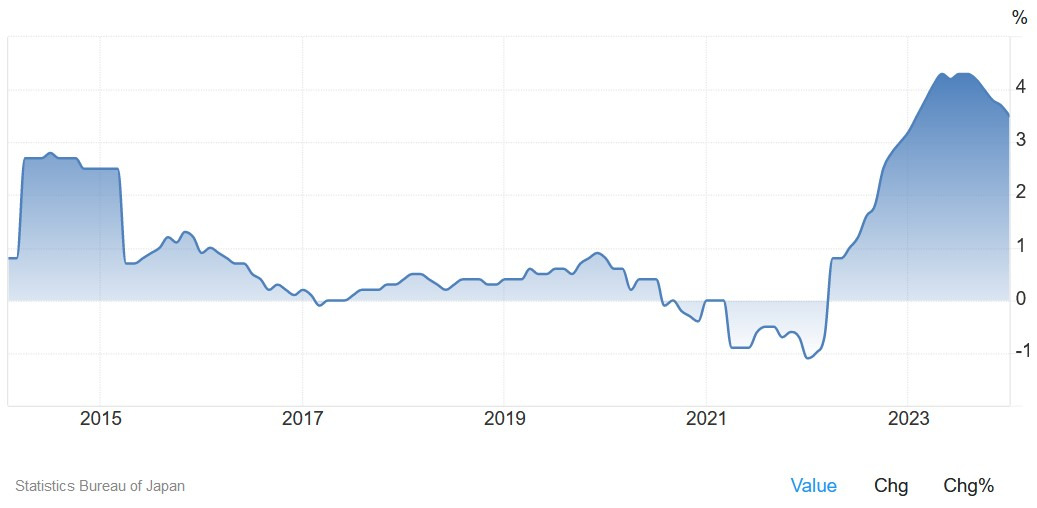

The BoJ is expected to finally exit the negative interest rate policy (NIRP) raising their policy rate by 10 bps. Moreover, the central bank is seen ditching yield curve control (YCC) but keeping QE and discontinue ETF purchases. Such expectations were solidified by many leaks and reports and the highest wage hikes in 30 years. The market has already priced in the BoJ exit, so there’s a big risk for disappointment. In fact, we can expect the Yen to selloff hard in case the central bank refrains from delivering on expectations. On the other hand, the bar for another round of big Yen gains is pretty high as the BoJ will need to sound hawkish and signal more to come.

The RBA is expected to keep the Cash Rate unchanged at 4.35%. Given the recent lower inflation numbers and another ugly labour market report, the central bank is likely to drop the tightening bias and keep a neutral stance. The market is expecting the first rate cut in August, but I suspect the market will bring expectations forward in case the RBA drops the tightening bias.

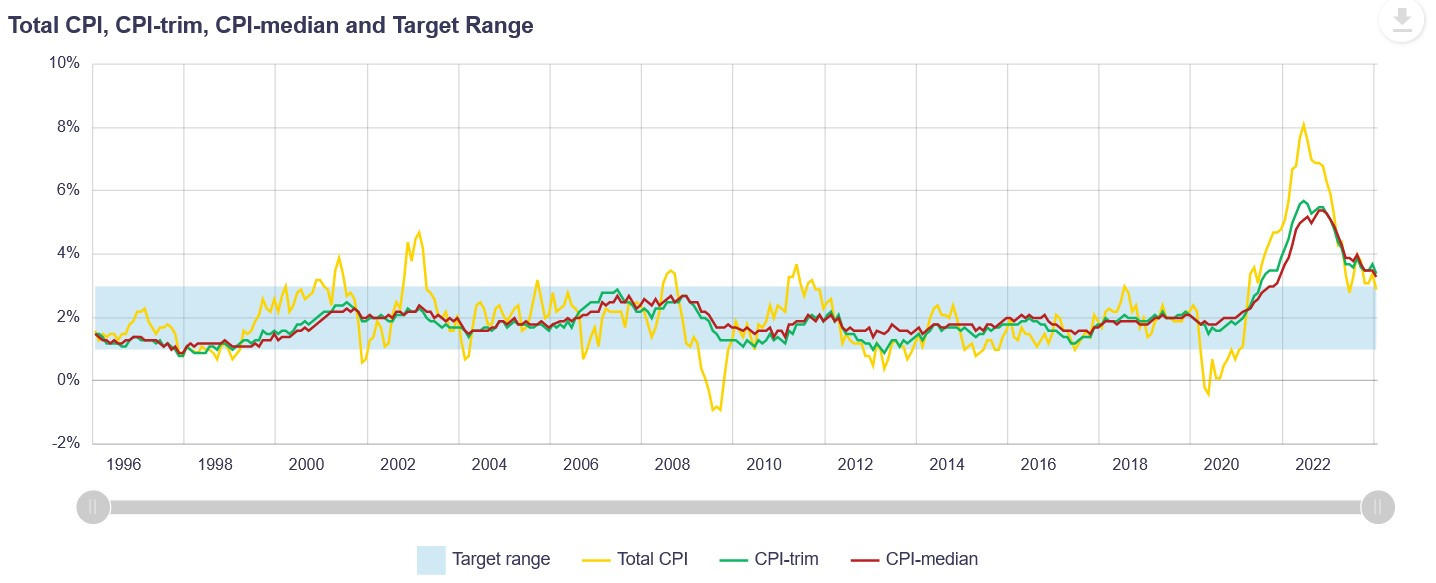

The Canadian CPI Y/Y is expected at 3.1% vs. 2.9% prior, while the M/M measure is seen at 0.6% vs. 0.0% prior. As always, the focus will be on the underlying inflation measures as that’s what the BoC is most concerned about. In the last report, we saw a miss across the board and it will certainly be good news for the central bank if it happens again, especially in light of the easing in wage growth in the recent labour market report. A miss is likely to weigh on the Canadian Dollar, while a beat shouldn’t change much for the market.

Wednesday

The PBoC is expected to keep the LPR rates unchanged. The central bank recently delivered two bigger than expected cuts to its RRR rate and the 5-year LPR rate. Last weekend, the Chinese Inflation data beat expectations across the board by a big margin with the Headline Y/Y reading jumping to 1.0% and the Core Y/Y measure to 1.2%. The PBoC might not feel the urgency to cut rates further at the moment.

The UK CPI is expected at 3.6% vs. 4.0% prior, while the M/M measure is seen at 0.7% vs. -0.6% prior. The Core CPI Y/Y is expected at 4.6% vs. 5.1% prior, while there’s no consensus for the M/M figure at the time of writing although the prior reading was -0.9%. The market expects the first rate cut in August and we will likely need a notable miss, especially for services inflation, to see the pricing shifting towards a June move.

The Fed is expected to keep interest rates unchanged at 5.25-5.50%. The focus will be on the economic projections and the dot plot. It’s unlikely to see major changes as the central bank will want to keep optionality and not overreact to the recent inflation readings. If the dot plot shifts from three to two rate cuts this year, that will be likely taken as a hawkish “surprise” by the market, but Fed Chair Powell could smooth it down in the Press Conference striking a more neutral message and saying that it’s all conditional to incoming economic data. On the other hand, if the dot plot still shows three rate cuts, Powell is likely to sound a bit more hawkish just to counterbalance the likely dovish reaction from the unchanged dot plot.

Thursday

Thursday will be the Flash PMIs day for many major economies, but the market will likely focus on the US ones:

- Eurozone Manufacturing PMI 47.0 vs. 46.5 prior.

- Eurozone Services PMI 50.5 vs. 50.2 prior.

- UK Manufacturing PMI 47.8 vs. 47.5 prior.

- UK Services PMI 54.0 vs. 53.8 prior.

- US Manufacturing PMI 51.7 vs. 52.2 prior.

- US Services PMI 52.0 vs. 52.3 prior.

The Australian unemployment rate is expected to tick lower to 4.0% vs. 4.1% prior, with 30K jobs added in February vs. 0.5K in January. The last report missed expectations across the board with the unemployment rate continuing to trend higher steadily. Another ugly report is likely to bring rate cuts expectations forward while a beat shouldn’t change much at this point.

There’s basically a 50/50 chance that the SNB cuts interest rates by 25 bps at the March meeting. The expectations for an earlier move rose after another downtick in the latest inflation data where the Headline CPI Y/Y eased to 1.2% and the Core CPI Y/Y to 1.1%, both well below the SNB’s projections and comfortably within the 0-2% inflation target. If the central bank refrains from cutting at this meeting, it’s very likely that they will signal a move in June and by then they could even cut by 50 bps.

The BoE is expected to keep interest rates unchanged at 5.25% with Mann and Haskel voting for a hike, Dhingra for a cut and the rest for a hold. The economic data leading into the meeting has been mostly benign with no particular surprises. The MPC will also see the latest UK inflation figures on the first day of the meeting, so that could influence the voting split but very unlikely to change anything else. The market is fully pricing the first rate cut in August.

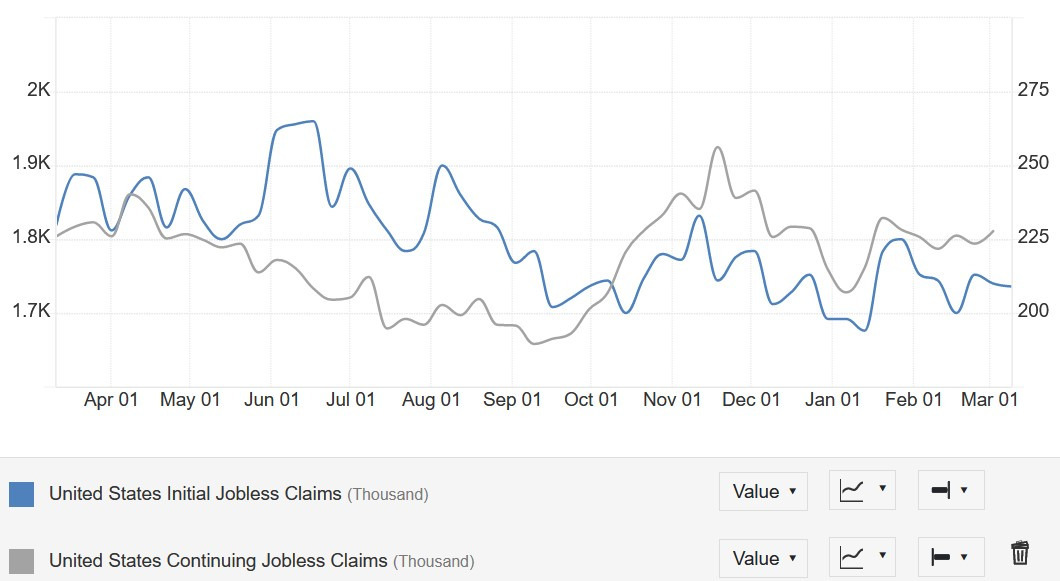

The US Jobless Claims continue to be one of the most important releases every week as it’s a timelier indicator on the state of the labour market. Initial Claims keep on hovering around cycle lows, while Continuing Claims remain firm around cycle highs. There’s no consensus at the time of writing for the claims figures, but the prior report saw a beat across the board with huge positive revisions to the Continuing Claims figures which led to a strong hawkish reaction in the markets. This is because disinflation to the Fed’s target is more likely with a weakening labour market. A resilient labour market though will make the achievement of the target much more difficult.

Friday

The Japanese Core CPI Y/Y is seen jumping to 2.8% vs. 2.0% prior with no consensus for the other measures although the prior readings saw the Headline CPI Y/Y at 2.2% and the Core-Core CPI Y/Y at 3.5%. Depending on the BoJ’s forward guidance at the policy decision, a beat will likely trigger a bigger reaction with the Yen strengthening across the board.